Introduction

Decentralized exchanges (DEXs) have emerged as a significant component of the cryptocurrency ecosystem, offering a decentralized and non-custodial alternative to traditional centralized exchanges. The growth and vitality of these platforms depend on various factors, including user interface and experience, security measures, liquidity incentives, and community engagement. However, this research paper focuses on four key areas that play a pivotal role in increasing DEX trading volume: DEX Arbitrage, Trading Activity Simulation, Liquidity Mining, and Gamification.

The actuality of this topic is underscored by the rapid evolution of the DeFi space and the increasing volume of trade facilitated by DEXs. As the cryptocurrency market matures, the mechanisms that drive trading volume and liquidity on DEXs become critical for the sustainability and efficiency of the market. This research is particularly timely and relevant as it explores innovative strategies beyond traditional methods to attract users and traders to the platform.

DEX Arbitrage involves exploiting price differences across various crypto exchanges to increase trading volume. Arbitrage bots examine cryptocurrency values and invest by exploiting discrepancies, ultimately contributing to increased trading activity and volume. By diversifying their trading across multiple exchanges, these bots can optimize liquidity management and reduce risk exposure, thus increasing trading volume.

Trading Activity Simulation refers to the practice of simulating trading activity to artificially increase volume on a DEX. While this can give the false impression of a highly liquid and active market, it’s important to note that such practices, known as “wash trading”, are illegal and unethical, as they mislead investors and market participants about the true level of activity and liquidity on the exchange.

Liquidity Mining is a strategy that DEXs can use to increase trading volume and liquidity on their platforms. This approach incentivizes users to provide liquidity by depositing their assets into liquidity pools, which are essential for facilitating trades on DEXs. By rewarding users for providing liquidity, DEXs can significantly increase the liquidity and trading volume on their platforms, making it easier for users to trade and improving the overall health of the exchange.

Gamification, or the application of game-design elements in non-game contexts, is another strategy used by DEXs to increase platform activity and trading volumes. DeFi apps use gamification or liquidity mining programs to encourage users to use the platform for some rewards. Most platforms use this method for marketing purposes.

This research paper aims to provide a comprehensive analysis of these strategies and their impact on the increase in DEX trading volume. The insights derived from this research will contribute to the understanding of the dynamics of DEXs and provide valuable information for DEX operators looking to boost their platforms’ trading volume and liquidity.

DEX Arbitrage

Arbitrage bots are essential for exploiting price differences across various crypto exchanges, thereby increasing trading volume. These bots examine cryptocurrency values and invest by exploiting discrepancies, ultimately contributing to increased trading activity and volume [1]. By diversifying their trading across multiple exchanges, these bots can optimize liquidity management and reduce risk exposure, thus increasing trading volume [2]. In the context of decentralized exchanges (DEX), arbitrage bots play a significant role in increasing trading volume by capitalizing on price differences between DEXs and centralized exchanges, ultimately contributing to more efficient and liquid markets [3].

Key points

Arbitrage Bots and Automated Arbitrage

Arbitrage bots are prevalent in the cryptocurrency market, and they play a significant role in DEXs. If your DEX operates similarly to established platforms like Uniswap, it’s likely that arbitrage bots will automatically engage in arbitrage activities. These bots monitor multiple DEXs for price discrepancies and execute trades to profit from these differences. The presence of arbitrage bots can lead to more efficient markets as they help to eliminate price discrepancies across different DEXs, thereby increasing trading volume [4][3][5].

Custom Arbitration Mechanics

For custom DEXs that may not have the same level of bot activity as larger, more established DEXs, developing proprietary arbitration mechanics can be beneficial. These mechanics would involve creating systems that can detect and exploit price discrepancies across different markets to adjust market prices on the DEX. By doing so, the DEX can attract more trading activity as traders and bots alike seek to capitalize on arbitrage opportunities [4].

Liquidity and Trading Volume Relationship

The relationship between liquidity and trading volume is a key factor in DEX arbitrage. Higher liquidity on a DEX generally leads to more trading volume from arbitrage activities. This is because with more liquidity, trades can be executed with less slippage, making arbitrage opportunities more profitable and less risky. As a result, arbitrageurs are more likely to trade on DEXs with higher liquidity, which in turn can drive up trading volume.

Conclusion

In summary, the presence of arbitrage bots on DEXs similar to Uniswap can lead to automatic arbitrage that helps align market prices across different platforms. For custom DEXs, developing unique arbitration mechanics can attract more trading activity. Additionally, focusing on increasing liquidity can lead to more arbitrage-driven trading volume, as arbitrageurs prefer markets where they can execute larger trades with minimal price impact. These factors collectively contribute to the overall goal of increasing trading volume and liquidity on DEXs.

Types of DEX arbitrage

There are several types of DEX arbitrage, each with its own characteristics and methods. The types of DEX arbitrage include:

Price Arbitrage

Price arbitrage in the context of decentralized exchanges (DEX) involves exploiting price differences between decentralized and centralized exchanges to make a profit. This can be achieved by buying an asset at a lower price on one exchange and selling it at a higher price on another exchange. Price arbitrage is a common trading strategy in various markets, including cryptocurrencies, and it helps correct market inefficiencies while allowing traders to benefit from the price differences. The use of arbitrage bots and algorithms is often employed to execute price arbitrage more efficiently and at scale, contributing to increased trading volume and liquidity on decentralized exchanges [3].

Common algorithm of the Price Arbitrage between DEXs

DEX arbitrage refers to the practice of exploiting price discrepancies between different DEXs for profit. Here’s an example of how a DEX arbitrage transaction might work:

- Identify Price Discrepancies: An arbitrageur monitors two DEXs, say DEX A and DEX B, and notices that a cryptocurrency, let’s call it Token X, is trading at a lower price on DEX A than on DEX B.

- Execute Trades Simultaneously: To capitalize on this discrepancy, the arbitrageur buys Token X on DEX A at the lower price and simultaneously sells the same amount of Token X on DEX B at the higher price. This can be done manually or through a smart contract that automates the process [3].

- Atomic Transactions: To minimize risk, the arbitrageur might use a specially crafted smart contract that executes these trades in a single atomic transaction. This ensures that either both trades are successful, or neither is, limiting the arbitrageur’s risk to the transaction fees (gas fees) paid for executing the trades [3].

- Profit Realization: The difference between the buy price on DEX A and the sell price on DEX B, minus transaction fees, represents the arbitrageur’s profit.

- Considerations: DEX arbitrageurs must consider factors such as slippage, which is the change in price due to the size of the trade affecting the liquidity pool, and transaction fees, which can eat into profits. They also need to act quickly, as price discrepancies can be short-lived due to other arbitrageurs acting on the same opportunity [3].

DEX arbitrage contributes to the overall health of the market by helping to ensure that prices for the same asset are consistent across different platforms. It also adds to the trading volume and liquidity of the DEXs involved, as arbitrageurs provide buy and sell orders that other market participants can trade against [3].

Funding rate arbitrage

Funding rate arbitrage is a trading strategy that takes advantage of the differences in funding rates between exchanges, particularly on perpetual future exchanges. The funding rate is a periodic payment made between long and short traders to ensure that the price of the perpetual contract stays close to the spot price of the underlying asset. Traders can profit from these differences by maintaining a delta-neutral position, which involves balancing the overall directional exposure of their positions. This strategy allows traders to earn funding fees without closing any of their positions, and it is particularly useful for hedging their positions in the futures market. Traders can access real-time and historical funding rate arbitrage data on various exchanges to inform their trading decisions [6][7][8].

Cross-Chain DEX Arbitrage

Cross-chain DEX arbitrage involves exploiting price differences across multiple blockchains to achieve profitable outcomes. This type of arbitrage is not limited to two chains and can involve operating across three or more chains to capitalize on price variability and inefficiencies [9]. The practice of cross-chain arbitrage has become increasingly important with the growth of the multi-chain ecosystem in the DeFi space. By identifying and leveraging price divergences across different blockchains, traders can profit from the variations in asset prices and contribute to the overall efficiency of the market [10].

The emergence of cross-chain interoperability solutions has facilitated the execution of arbitrage opportunities across different blockchains. This has opened up new possibilities for traders to engage in profitable strategies that span multiple chains, thereby increasing the potential for arbitrage opportunities and market efficiency [11].

In summary, cross-chain DEX arbitrage involves leveraging price differences across multiple blockchains to generate profits, and it has become an important aspect of trading within the multi-chain DeFi ecosystem.

Trading activity simulation

Disclaimer

This document, including all related materials and information (hereafter, “the Research”), is provided for informational purposes only. It is intended to offer technical insights of a simulated trading activity on Decentralized Exchanges (DEXs) based on theoretical models, assumptions, open source code and publicly available information. The authors and contributors to the Research make no representation or warranties, express or implied, as to the accuracy, completeness, or reliability of the information contained within. The information on simulations and hypothetical trading scenarios presented in the Research are purely illustrative and should not be interpreted as financial, legal, investment, or call to action advice.

Security and risks

While simulating trading activity through multiple wallets can artificially increase volume on a DEX, it carries significant ethical, legal, and reputational risks. Focusing on legitimate strategies to enhance the platform’s value proposition is a more sustainable approach to increasing trading volume and liquidity.

Market manipulation, including practices that artificially inflate trading volume, is generally considered unethical and is illegal in many jurisdictions. The CFA Institute’s Standard II(B) on Market Manipulation explicitly states that members and candidates must not engage in practices that distort prices or artificially inflate trading volume with the intent to mislead market participants [14]. This standard underscores the importance of maintaining integrity and transparency in financial markets.

Impact on Market Perception

Artificially inflating trading volume can temporarily enhance the perceived liquidity and activity of a DEX, potentially attracting more users. However, this can lead to a misrepresentation of the platform’s true market activity and liquidity. Over time, such practices can erode trust among users and investors when they realize the volume does not reflect genuine market interest [12][13].

Risks of Detection and Repercussions

With advancements in blockchain analytics, detecting wash trading and other forms of manipulation has become increasingly feasible. Exchanges found to be engaging in such practices risk regulatory action, loss of reputation, and a potential exodus of legitimate users [12][14]. The long-term damage to trust and credibility can outweigh any short-term gains in trading volume.

The main components

Creating Multiple Wallets

To perform the trading simulation the trader needs several wallets which would trade with each other. Creating multiple wallets to pass anti-Sybil checks involves a careful process to avoid detection. Sybil attacks refer to the malicious act of creating multiple identities (in this case, wallets) to influence a network or gain an unfair advantage. Anti-Sybil measures are put in place to prevent such behavior. Here are some steps:

- Creating Multiple Wallets: The first step is to create several wallets. This can be done using various wallet providers or scripts and libraries. Each wallet should be treated as a separate entity [15].

- Avoid Direct Transfers Between Wallets: Avoid sending funds directly between your wallets. This creates a direct connection that can be easily detected by anti-Sybil mechanisms. Instead, use centralized exchanges (CEXs) to send funds between wallets [16][18].

- Use Unique IP Addresses: Use a unique IP address for each wallet. If the same IP address is used for multiple wallets, it will be easy for the project to detect that you are a Sybil attacker. Using a VPN and proxies can help change your IP address [17].

- Vary Transaction Patterns: Vary your transaction patterns to avoid detection. Don’t create multiple wallets too quickly or make similar transactions at the same time. These patterns can be detected by anti-Sybil mechanisms [17].

- Maintain Activity in Each Wallet: Each wallet should have a history of genuine transactions. If all transactions occur within a short period, it could be flagged as a Sybil wallet. Normal wallets have transactions in multiple networks.

Remember, while these steps can help avoid detection, creating multiple wallets to pass anti-Sybil checks is generally considered unethical and can lead to penalties if detected. It’s always best to follow the rules and guidelines set by the project or platform you’re participating in [15][17].

Executing Trades Between Wallets

The trader then executes trades between these wallets, buying and selling the same asset back and forth.

To scale this activity, the trader might use automated trading bots to execute these trades rapidly and at various times to mimic real trading activity. In the next sections there will be presented tools for creation of trading simulation.

Telegram bots

Telegram trading bots are automated software programs that execute trades based on predefined algorithms and market conditions. They are built on the Telegram messaging platform and can provide automation, real-time market data, and advanced technical analysis tools, enabling hands-off trading, informed decision-making, and risk-management options [19][20][21].

Here’s a step-by-step guide on how to use Telegram trading bots for automated trading [22][23]:

- Select a Trading Bot: Choose a Telegram trading bot that is capable of interacting with the DEX you are targeting. Popular bots like Unibot have been mentioned for their efficiency in executing trades. The list of top trading/sniper bots can be found in [32].

- Set Up the Bot: After selecting a bot, you need to set it up by connecting it to your DEX through the use of API keys or smart contracts. This allows the bot to execute trades on the DEX on your behalf.

- Configure Trading Parameters: Define the trading strategy for the bot, including which tokens to trade, the size of the trades, frequency, and any specific conditions under which trades should be executed. This could include setting up stop-loss and take-profit orders to automate the trading process.

- Test the Bot: Before going live, test the bot with small trades to ensure it operates as expected. Monitor the bot’s activity to make sure it is not creating any patterns that could be easily identified as artificial.

- Monitor and Adjust: Continuously monitor the bot’s trading activity and adjust the parameters as needed to maintain the appearance of natural trading volume. This includes varying the trade sizes, timing, and possibly interacting with different wallets to distribute the trades.

- Ensure Security: Make sure to secure your Telegram account with two-factor authentication to prevent unauthorized access to your trading bots.

- Comply with Legal Standards: It’s crucial to note that using bots to simulate trading activity can be considered market manipulation, known as “wash trading”. This practice is illegal and unethical in many jurisdictions. It’s important to comply with all legal standards and avoid engaging in any activities that could be considered market manipulation.

It’s important to note that such bots have limits on the Blockchains and DEXs. For example, the most popular of them don’t support the Polygon blockchain.

Github open-source

Open-source trading bots available on GitHub can indeed be used to simulate trading activity on a DEX. These bots can be customized to execute trades based on predefined strategies, which can help simulate trading activity. Here are some examples:

EVM Dex Bot

The EVM Dex Bot is a complex, multifunctional trading bot designed for the EVM ecosystem. It offers a wide range of features to automate and optimize your trading activities. Key features include Dex Limit Orders, Dex Stop Loss, Dex trailing stop loss, and real-time trade notifications via Apprise. The bot is also capable of Mempool Sniping, Pink Sale Sniping, and has an Accumulation Mode. Other features include Take profit, trailing take profit, multi-pair/multi-wallet trading, multi-pair monitoring, Grid trading, Automated Rug Doc, Front run, Liquidity check/monitoring, and Private key encryption. The bot supports EIP 1559, custom exchange wrappers, and can trade any pair combination. It also supports fully automated strategies, although this requires advanced configuration. The source code for EVM Dex Bot can be found in [33].

PancakeSwap Token Volume Booster

The PancakeSwap Token Volume Booster is a user-friendly script designed to automate the buying and selling of tokens from different accounts based on a predefined configuration. It uses configured accounts with some amount of token0/token1 and executes swaps of tokens owned by these accounts. The bot offers the option to apply randomization to the trading activity, making it easy to simulate a variety of trading patterns. The script is designed to be easy to modify, allowing users to implement custom logic to suit their specific needs. This bot is particularly useful for increasing token trading volume on the PancakeSwap v2 DEX and other similar DEXs. The implementation for PancakeSwap Token Volume Booster can be found in [34].

Other considerations of trading strategies

The owner could vary the trade sizes and frequency to create the illusion of a vibrant and active market.

Also, by repeatedly executing these trades, the owner inflates the trading volume statistics of the DEX, making it appear more active and liquid than it actually is [24][25].

This simulated activity could also create the appearance of liquidity, as the wash trades would show up as both buy and sell orders being filled [26].

Liquidity mining and gamification

To increase platform activity such as LPs and trading volumes, DeFi apps use gamification or liquidity mining programs to encourage users to use the platform for some rewards. Most platforms use this method for marketing purposes.

Liquidity Mining

Liquidity mining is a strategy that DEX can use to increase trading volume and liquidity on their platforms. This approach incentivizes users to provide liquidity by depositing their assets into liquidity pools, which are essential for facilitating trades on DEXs. Here’s a detailed look at how liquidity mining works and its implications for DEX owners looking to boost their platforms:

Understanding Liquidity Mining

Liquidity mining involves users locking their crypto assets in a DEX’s liquidity pool to earn rewards, typically in the form of the platform’s native tokens or a share of the trading fees collected from the DEX. This process not only provides the necessary capital for executing trading services but also ensures a liquid base of digital capital, which is crucial for the smooth operation of DEX trading systems [27][28][29][30].

Benefits for DEX

Table 1 – Benefits of Liquidity Mining [29].

| Benefit | Description |

| Increased Liquidity and Trading Volume | By rewarding users for providing liquidity, DEX can significantly increase the liquidity and trading volume on their platforms. This makes it easier for users to trade and improves the overall health of the exchange. |

| Attracting New Users | Liquidity mining can attract new users to the platform, as it offers an additional income stream for crypto holders. This can lead to a more vibrant and active DEX ecosystem. |

| Enhanced Platform Competitiveness | With more liquidity, a DEX becomes more competitive in the DeFi space. It can offer better prices and lower slippage, making it a more attractive option for traders. |

Implementing Liquidity Mining on the DEX

- Define Reward Mechanisms: Decide on the type of rewards to offer (e.g., native tokens, trading fee shares) and the criteria for earning these rewards. This could include the amount of liquidity provided, the duration of liquidity provision, or participation in specific liquidity pools [27][28].

- Develop Smart Contracts: Develop and deploy smart contracts that will manage the liquidity mining process. These contracts should handle the distribution of rewards, the locking and unlocking of assets, and any other functionalities required for your liquidity mining program. The SushiSwap MasterChief is an example of such a smart-contract that has found widespread use [35].

- Promote Your Liquidity Mining Program: Use various channels to promote your liquidity mining program to potential liquidity providers. This could include social media, crypto forums, and partnerships with other DeFi projects [30][31].

- Monitor and Adjust: Continuously monitor the performance of your liquidity mining program and make adjustments as needed. This could involve changing reward structures, adding new liquidity pools, or implementing additional incentives to maintain interest and participation [30][31].

Risks and Considerations

While liquidity mining can be a powerful tool for increasing DEX trading volume and liquidity, it comes with risks such as impermanent loss, project risk, and potential for manipulation (e.g. rug pulls) [30][31]. DEX owners must carefully design their liquidity mining programs to mitigate these risks and ensure the long-term sustainability of their platforms.

In conclusion, liquidity mining is a strategic approach that DEX can use to enhance trading volume and liquidity. By incentivizing users to provide liquidity, DEXs can improve their competitiveness, attract new users, and foster a more robust DeFi ecosystem. However, it’s crucial to carefully manage the risks associated with liquidity mining to ensure the success and sustainability of the program.

Examples of successful liquidity mining programs

Liquidity mining has been a successful strategy for several projects in the DeFi space, helping to increase trading volume and liquidity on their platforms. Here are some examples of projects that have implemented liquidity mining effectively:

Uniswap

Uniswap is a leading decentralized exchange that has utilized liquidity mining to incentivize users to provide liquidity. By offering rewards in the form of its governance token, UNI, Uniswap has been able to attract a significant amount of liquidity, making it one of the most popular DEXs in the market [36][37].

Balancer

Balancer introduced a liquidity mining program in March 2020 by distributing BAL governance tokens to liquidity providers. This program helped to increase the platform’s liquidity and trading volume by rewarding users for contributing to their automated market maker pools [36].

Compound

The Compound protocol launched a liquidity mining program that rewarded users with COMP tokens for providing liquidity to its lending pools. This program was a big success, attracting many new users and increasing the volume of trades on the COMP/ETH pair. The value of the COMP token also increased significantly, becoming one of the most valuable DeFi tokens with a market capitalization of over $1 billion [38].

SushiSwap

SushiSwap managed to briefly overtake rival Uniswap in terms of liquidity by offering lucrative liquidity mining rewards. The platform’s incentive program attracted a large number of liquidity providers, contributing to its growth and success [39].

These projects demonstrate the effectiveness of liquidity mining as a tool for distributing tokens, attracting liquidity providers, and ultimately increasing trading volume on DEXs.

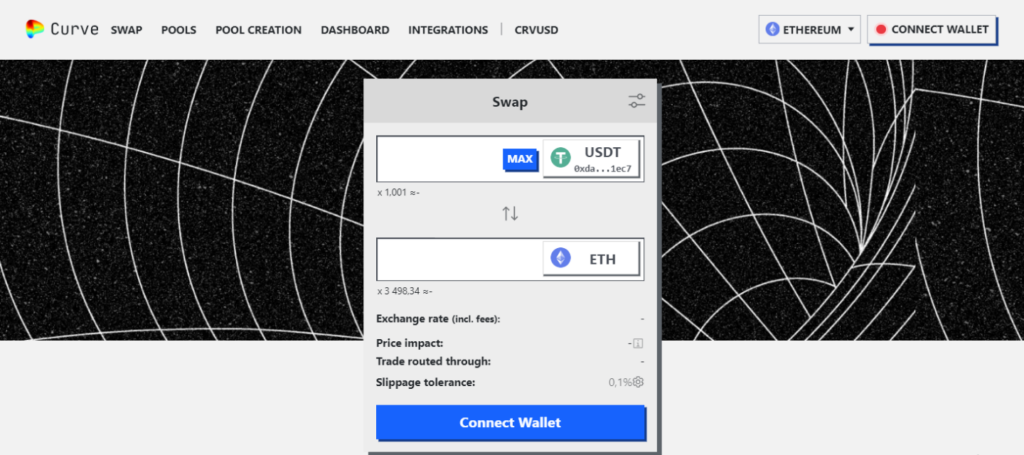

Case of study: Curve Wars

The concept of “DeFi Wars,” particularly the “Curve Wars,” represents a significant phenomenon in the DeFi ecosystem, focusing on the battle for liquidity among various protocols. This battle has direct implications for increasing DEX trading volume and liquidity.

What are the Curve Wars?

The Curve Wars refer to the intense competition among DeFi protocols to accumulate and control voting power within the Curve Finance ecosystem. Curve Finance is a DEX on the Ethereum blockchain, specializing in stablecoin swaps with minimal slippage due to its deep liquidity pools [40][41][42]. The governance token of Curve, CRV, can be locked to obtain veCRV, which grants voting power in governance decisions, including determining the allocation of CRV token emissions to various liquidity pools [42][43][44].

Implications for DEX Trading Volume and Liquidity

Increased Liquidity and Trading Volume

The primary goal of participating in the Curve Wars is to direct more liquidity rewards towards a protocol’s preferred liquidity pools. By doing so, protocols can enhance the attractiveness of providing liquidity to their pools, thereby increasing both the liquidity and trading volume on Curve. This is because liquidity providers are incentivized by the prospect of earning higher rewards [42][43].

Attracting New Protocols and Users

The Curve Wars have led to the emergence of new protocols, such as Convex Finance, which aim to accumulate CRV tokens and veCRV voting power. These protocols offer their own incentives to users for staking CRV with them, further amplifying the competition for liquidity. This ecosystem of interrelated protocols and incentives attracts more users and liquidity providers to the Curve platform, contributing to its growth and the overall DeFi ecosystem [43][44].

Enhancing Protocol Competitiveness

Protocols that successfully accumulate significant veCRV holdings can influence the distribution of liquidity mining rewards on Curve. This ability to steer rewards towards their preferred pools can make these protocols more competitive, as they can offer better returns to liquidity providers. The increased competitiveness of these protocols can lead to more trading activity and liquidity on Curve [42][43].

Risks and Challenges

While the Curve Wars have contributed to the growth of Curve’s liquidity and trading volume, they also expose the platform and its participants to certain risks. The intense focus on accumulating veCRV can lead to centralization concerns, where a few large holders have disproportionate influence over the platform’s governance [40][44]. Additionally, the competitive dynamics can lead to complex incentive structures that may be challenging for new users to navigate [42].

Conclusion

The Curve Wars represent a fascinating aspect of DeFi’s competitive landscape, showcasing how protocols vie for liquidity and influence to increase their trading volume and liquidity. By understanding and participating in these dynamics, DEX owners can potentially leverage the competitive strategies seen in the Curve Wars to enhance their platforms’ attractiveness to liquidity providers and traders. However, it’s crucial to balance these strategies with considerations for platform governance, user experience, and long-term sustainability.

Gamification and airdrop campaigns

Gamification and airdrop campaigns are two strategies that can be employed by DEX to increase trading volume and liquidity on their platforms. Here’s how they can be integrated:

Gamification

Gamification involves incorporating game-like elements into non-gaming environments to boost user engagement and participation. For DEX, this can mean creating challenges, quests, or competitions that are tied to trading activities. For example, users could earn points or rewards for completing certain trades, providing liquidity, or reaching certain trading volume thresholds. These rewards could be in the form of tokens, NFTs, or other digital assets that have value within the DEX ecosystem [45][47][51][52].

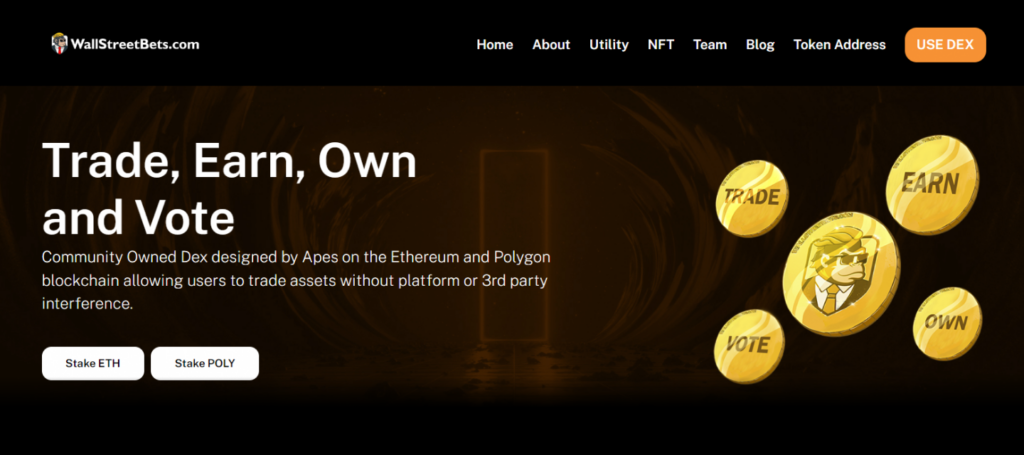

An example of gamification in action is Wallstreetbets DEX, which offers a DEX NFT game tied directly to DEX activities like contributing liquidity. Users can receive NFTs for performing certain actions on the DEX, such as holding a specific token or maintaining a certain trade volume [47]. Another instance is Merkle V2, which has gamified trading by offering items gained from loot boxes that can be soulbound (non-transferable) and regular, adding an extra layer of engagement to the trading experience [49].

Airdrop Campaigns

Airdrop campaigns involve distributing free tokens to the crypto community, often to reward early adopters, incentivize new users, or encourage holding of the platform’s tokens. For a DEX owner, setting criteria for receiving airdrops based on activities such as DEX swaps, liquidity provision, and social media engagement can be an effective way to boost platform use and liquidity [50].

For instance, the Position Exchange DEX introduced an Airdrop Incentives Campaign with various small campaigns that reward users for trading on their DEX 2.0. These campaigns include liquidity provider incentives and task bounty airdrops, which distribute rewards based on user participation [48]. Another example is the meme coin “SMOG”, which allocated a portion of its token supply for DEX liquidity and locked it through a third-party service to ensure trust. The token’s airdrop-focused structure aimed to increase price growth and liquidity on the DEX [46].

By combining gamification with airdrop campaigns, DEX can create a more engaging and rewarding experience for users, which can lead to increased trading volume and liquidity. These strategies not only incentivize users to participate in the DEX’s ecosystem but also help in building a loyal community that supports the platform’s long-term growth. However, it’s important to design these campaigns carefully to ensure they are fair, transparent, and align with the overall goals of the DEX.

Case of Study: Hashflow

Hashflow [53] is a multichain DEX that enables users to trade digital assets on leading blockchains including Ethereum, Arbitrum, Avalanche, BNB Chain, Optimism, Polygon, and Solana in just a matter of seconds.

The platform has interesting marketing campaigns attracting users to the platform: community incentives and first-of-its-kind gaming mechanics for traders – Hashverse.

Hashflow community incentives

Hashflow has community incentive programs that attract both traders and MMs. They have allocated supply for each type of reward. Trading rewards they calculate according to traded USD for each user [54]:

- for each stable coin trade, the user will earn 0.0001 HFT per USD traded

- for each non-stable coin trade, the user earns 0.0005 HFT per USD traded

For market making rewards they compute the rewards based on their pro-rata share of the total trading volume on the platform in the given month [55].

Hashverse

The Hashflow also has a gamified trading platform and DAO experience named Hashverse [56]. The goal of the Hashverse is to make trading and governance fun, empowering, and inclusive across web3 communities, with open participation and the opportunity to earn real rewards.

The gameplay is based on the trading and other platform interaction tasks. Each player has its own character which can be upgraded by completing tasks and using in-game NFT items. The game also has the multiplayer mode allowing players to unite into the teams.

Case of Study: Tensor Trade

Another example of a successful airdrop campaign is a fast-growing Solana marketplace – Tensor trade [57]. It is currently the #1 NFT marketplace on Solana, with a daily trading volume of almost $4 million. Much of the success of this marketplace lies in its rewards campaign.

Tensor is currently running its Season 3 airdrop on the Solana blockchain. To participate in the airdrop, users need to trade and market-make on Tensor to earn Tensor Points based on order depth and floor proximity. The points counter is hidden to prevent abuse and ensure a healthy NFT market. Users who qualify for the airdrop will have the opportunity to win big and potentially receive a TNSR governance token [59]. Tensor also offers a loyalty system that rewards users for their activity in the market, giving them points that they can exchange for exclusive NFTs, discounts, and other rewards [59]. The requirements for Season 3 are similar to those of Season 2, and users can earn points by listing NFTs, bidding on NFTs, market-making NFTs, staking Tensorians, and referring friends [58][59].

Conclusion

The research paper has explored four key strategies that can potentially increase trading volume on decentralized exchanges (DEXs): DEX Arbitrage, Trading Activity Simulation, Liquidity Mining, and Gamification.

DEX Arbitrage, which involves exploiting price differences across various crypto exchanges, has been identified as a significant factor in increasing trading volume. Arbitrage bots play a crucial role in this process, as they monitor multiple DEXs for price discrepancies and execute trades to profit from these differences. The presence of these bots can lead to more efficient markets as they help to eliminate price discrepancies across different DEXs, thereby increasing trading volume. Additionally, the relationship between liquidity and trading volume is a key factor in DEX arbitrage. Higher liquidity on a DEX generally leads to more trading volume from arbitrage activities, as arbitrageurs prefer markets where they can execute larger trades with minimal price impact.

Trading Activity Simulation, although a more risky method, can directly increase the trading volume, giving the false impression of market activity. However, it’s important to note that simulating trading activity to artificially increase volume on a DEX involves a practice known as “wash trading”, which is illegal and unethical. It misleads investors and market participants about the true level of activity and liquidity on the exchange and can lead to regulatory action, loss of reputation, and a potential exodus of legitimate users when discovered.

Liquidity Mining is a strategic approach that DEX can use to enhance trading volume and liquidity. By incentivizing users to provide liquidity, DEXs can improve their competitiveness, attract new users, and foster a more robust DeFi ecosystem. This method has generated successful practices like “Curve Wars”.

Gamification, combined with airdrop campaigns, can create a more engaging and rewarding experience for users, leading to increased trading volume and liquidity. These strategies not only incentivize users to participate in the DEX’s ecosystem but also help in building a loyal community that supports the platform’s long-term growth. Examples of successful gamification and airdrop campaigns are Hashflow and Tensor Trade.

In conclusion, while each of these strategies has its own merits and challenges, they all contribute to the overall goal of increasing trading volume and liquidity on DEXs. However, it’s crucial to implement these strategies ethically and legally to maintain the trust of users and the broader crypto community. As the DeFi ecosystem continues to evolve, DEXs that can effectively leverage these strategies while maintaining high standards of security, transparency, and user experience are likely to thrive.

References

- CEX and DEX arbitrage bots: technical performance challenges – SCAND [online]. Accessed 05.02.2024. Available: https://scand.com/company/blog/what-are-crypto-arbitrage-bots-and-how-to-use-them/

- Developing and Backtesting DEX/CEX Arbitrage Trading Strategies – Amberdata [online]. Accessed 05.02.2024. Available: https://blog.amberdata.io/developing-and-backtesting-dex-cex-arbitrage-trading-strategies

- A Deep Dive into Arbitrage on Decentralized Exchanges – Nansen [online]. Accessed 05.02.2024. Available: https://www.nansen.ai/research/arbitrage-on-decentralised-exchanges

- MEV Bot Guide: Create an Ethereum Arbitrage Trading Bot – Blocknative [online]. Accessed 05.02.2024. Available: https://www.blocknative.com/blog/mev-and-creating-a-basic-arbitrage-bot-on-ethereum-mainnet

- Deep Dive into Maximal Extractable Value (MEV) – Madelyn Nora [online]. Accessed 05.02.2024. Available: https://www.linkedin.com/pulse/deep-dive-maximal-extractable-value-mev-madelyn-nora

- How to Arbitrage Between CEXs & DEXs – Drift [online]. Accessed 06.02.2024. Available: https://www.drift.trade/blog/how-to-arbitrage-between-cexs-dexs

- Funding Rate Arbitrage 101 – Polynomial Trade [online]. Accessed 06.02.2024. Available: https://docs.trade.polynomial.fi/strategies-and-tools/funding-rate-arbitrage-101

- Perpetual Funding Rate – dYdX [online]. Accessed 06.02.2024. Available: https://help.dydx.exchange/en/articles/4797443-perpetual-funding-rate

- What Are the Types of Crypto Arbitrage – Equalizer Finance [online]. Accessed 06.02.2024. Available: https://equalizer.finance/blog/what-are-the-types-of-crypto-arbitrage

- Developing and Backtesting DEX/CEX Crypto Arbitrage Trading Strategies – Amberdata Blog [online]. Accessed 06.02.2024. Available: https://blog.amberdata.io/developing-and-backtesting-dex-cex-arbitrage-trading-strategies

- Crypto Arbitrage on Decentralized and Centralized Exchanges – Alpaca Markets [online]. Accessed 06.02.2024. Available: https://alpaca.markets/learn/arbitrage-on-decentralized-exchange-centralized-exchange

- Manipulation: Definition, Methods, Types, and Example – Investopedia [online]. Accessed 06.02.2024. Available: https://www.investopedia.com/terms/m/manipulation.asp

- Market Manipulation – Corporate Finance Institute [online]. Accessed 06.02.2024. Available: https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/market-manipulation/

- Standards of Practice II(B) – CFA Institute [online]. Accessed 06.02.2024. Available: https://www.cfainstitute.org/en/ethics-standards/ethics/code-of-ethics-standards-of-conduct-guidance/standards-of-practice-II-B

- Don’t eliminate real users to catch sybil – StarkNet Community [online]. Accessed 06.02.2024. Available: https://community.starknet.io/t/dont-eliminate-real-users-to-catch-sybil/85875

- How to Never Be Sybil on Airdrops – Cryptocurrency State [online]. Accessed 06.02.2024. Available: https://www.cryptocurrencystate.net/airdrop/how-to-never-be-sybil-on-airdrops/

- Outsmarting the System: Sybil Attacks in Airdrop Farming – Droppables XYZ [online]. Accessed 06.02.2024. Available: https://droppables.beehiiv.com/p/sybil

- A Closer Look at the Anti-Sybil Mechanism Under the Arbitrum – Beosin [online]. Accessed 07.02.2024. Available: https://beosin.com/resources/a-closer-look-at-the-anti-sybil-mechanism-under-the-arbitrum?lang=en-US

- Boost Crypto Trading With Telegram Trading Bots: Everything to Know – Crypto.com [online]. Accessed 07.02.2024. Available: https://crypto.com/university/crypto-trading-with-telegram-trading-bots-everything-to-know

- What are Telegram Trading Bots? – Cointelegraph (online). Accessed 07.02.2024. Available: https://cointelegraph.com/news/what-are-telegram-trading-bots

- What are Telegram Trading Bots and How to Use Them? – Binance Academy [online]. Accessed 07.02.2024. Available: https://academy.binance.com/en/articles/what-are-telegram-trading-bots-and-how-to-use-them

- Telegram Crypto Trading Bots: Convenience vs. Security Risks – Hacken [online]. Accessed 07.02.2024. Available: https://hacken.io/discover/telegram-crypto-trading-bots-risks/

- Telegram Bot Coins: A Beginner’s Guide 2024 – CCN [online]. Accessed 07.02.2024. Available: https://www.ccn.com/education/telegram-bot-coins-beginners-guide-2024/

- Wash Trading Is Rampant on Decentralized Crypto Exchanges – Bloomberg [online]. Accessed 08.02.2024. Available: https://www.bloomberg.com/news/articles/2023-09-12/wash-trading-is-rampant-on-decentralized-crypto-exchanges

- Crypto Wash Trading – Solidus Labs [online]. Accessed 08.02.2024. Available: https://www.soliduslabs.com/reports/crypto-wash-trading

- Solidus Labs Uncovers $2 Billion Worth of Wash Trades on Decentralized Exchanges – BusinessWire [online]. Accessed 08.02.2024. Available: https://www.businesswire.com/news/home/20230912351705/en/Solidus-Labs-Uncovers-2-Billion-Worth-of-Wash-Trades-on-Decentralized-Exchanges

- What is Liquidity Mining? – The Motley Fool [online]. Accessed 08.02.2024. Available: https://www.fool.com/terms/l/liquidity-mining/

- The Complete Guide to Liquidity Mining – Nansen.ai [online]. Accessed 08.02.2024. Available: https://www.nansen.ai/guides/the-complete-guide-to-liquidity-mining

- Liquidity Mining – What It Means and How It Works? – Token Metrics Blog [online]. Accessed 08.02.2024. Available: https://www.tokenmetrics.com/blog/liquidity-mining

- Understanding Liquidity Mining: An Introductory Guide – Coindoo [online]. Accessed 08.02.2024. Available: https://coindoo.com/liquidity-mining/

- DeFi Liquidity Mining: Everything You Need to Know About – Prillionaires [online]. Accessed 08.02.2024. Available: https://prillionaires.com/blog/defi-liquidity-mining-everything-you-need-to-know-about/

- DEX Trading Bot Wars – Dune [online]. Accessed 08.02.2024. Available: https://dune.com/whale_hunter/dex-trading-bot-wars

- EVM Dex Bot – Github [online]. Accessed 08.02.2024. Available: https://github.com/gweidart/alpha-evm-dex-bot

- PancakeSwap Token Volume Booster – Github [online]. Accessed 09.02.2024. Available: https://github.com/v0idum/pancakeswap_token_volume_booster/tree/master

- MasterChef – Github [online]. Accessed 09.02.2024. Available: https://github.com/sushiswap/masterchef

- Top 10 Crypto Liquidity Pools in 2022 – 101blockchains [online]. Accessed 09.02.2024. Available: https://101blockchains.com/top-crypto-liquidity-pools/

- Top 10 Amazing Case Studies Of Successful DeFi Projects And Their Token Emission Approaches – Blockchain Magazine [online]. Accessed 09.02.2024. Available: https://blockchainmagazine.net/top-10-case-studies-of-successful-defi-projects/

- Liquidity Mining – How Does It Work? – Empirica [online]. Accessed 09.02.2024. Available: https://empirica.io/blog/liquidity-mining/

- Liquidity Mining Is Dead. What Comes Next? – CoinDesk [online]. Accessed 09.02.2024. Available: https://www.coindesk.com/tech/2022/01/19/liquidity-mining-is-dead-what-comes-next/

- As Curve Averts DeFi Death Spiral, Fiasco Exposes Serious Risks – CoinDesk [online]. Accessed 09.02.2024. Available: https://www.coindesk.com/tech/2023/08/09/as-curve-averts-defi-death-spiral-fiasco-exposes-serious-risks/

- Curve Finance – Charlie DeFi [online]. Accessed 09.02.2024. Available: https://www.charliedefi.com/dapps/curve-finance

- Field Guide to the Curve Wars: DeFi’s Fight for Liquidity – Nat’s Crypto Newsletter [online]. Accessed 09.02.2024. Available: https://crypto.nateliason.com/p/curve-wars

- What Is Curve Finance? Curve Wars Explained – Neptune Mutual [online]. Accessed 12.02.2024. Available: https://neptunemutual.com/blog/what-is-curve-finance-curve-wars-explained/

- ITSA DeFi Insight – Curve, Convex and the Curve Wars – ITSA Blog [online]. Accessed 12.02.2024. Available: https://my.itsa.global/blog/curve-convex-and-the-curve-wars

- “Trading Through Gamification Can Represent the Future” Says Banksters’ Alexandru Carbunariu – Bitcoin.com [online]. Accessed 12.02.2024. Available: https://news.bitcoin.com/trading-through-gamification-can-represent-the-future-says-banksters-alexandru-carbunariu/

- New Airdrop-Focused Meme Coin ‘SMOG’ Sees Fair Launch on SOL And Soars 1,400% In First Hour – CryptoPotato [online]. Accessed 12.02.2024. Available: https://cryptopotato.com/new-airdrop-focused-meme-coin-smog-sees-fair-launch-on-sol-and-soars-1400-in-first-hour/

- This platform is blending NFT avatars with DEX activity – Cointelegraph [online]. Accessed 12.02.2024. Available: https://cointelegraph.com/news/this-platform-is-blending-nft-avatars-with-dex-activity

- Position Exchange DEX Airdrop Introduction – Position Exchange [online]. Accessed 12.02.2024. Available: https://docs.position.exchange/products/dex-2.0/incentives-programs/position-exchange-dex-airdrop-introduction

- X – MTS (@matrixthesun) [online]. Accessed 12.02.2024. Available: https://twitter.com/matrixthesun/status/1752686081852805532

- How To Make An Airdrop To Reward Your Crypto Community – Empirica [online]. Accessed 12.02.2024. Available: https://empirica.io/blog/how-to-make-an-airdrop-to-crypto-community/

- Dexilon Growth Strategy 2023 – Dexilon [online]. Accessed 12.02.2024. Available: https://dexilon.io/blog/dexilon-growth-strategy/

- 9 Tips on How to Create a DEX that Stands Out – Rock’n’ block’ [online]. Accessed 12.02.2024. Available: https://rocknblock.io/blog/how-to-create-dex-that-stands-out

- Hashflow 2.0 [online]. Accessed 12.02.2024. Available: https://www.hashflow.com/

- Trading Rewards – Hashflow [online]. Accessed 12.02.2024. Available: https://docs.hashflow.com/hashflow/hft-and-governance/community-incentives/trading-rewards

- Market Making Rewards – Hashflow [online]. Accessed 12.02.2024. Available: https://docs.hashflow.com/hashflow/hft-and-governance/community-incentives/market-making-rewards

- Hashverse [online]. Accessed 12.02.2024. Available: https://www.hashflow.com/hashverse/home

- Tensor Trade [online]. Accessed 12.02.2024. Available: https://www.tensor.trade/

- Tensor – Season 3 (Tensor Points) Airdrop – AirdropAlert.com [online]. Accessed 12.02.2024. Available: https://airdropalert.com/tensor-season-3-airdrop

- Tensor airdrop: The TNSR token guide – Phantom [online]. Accessed 12.02.2024. Available: https://phantom.app/learn/crypto-101/tensor-tnsr-airdrop

Got Web3 questions?

We’ve got answers and would be happy to discuss them with you